by Kyle Conway

If you read North Dakota’s newspapers during the boom, the picture was pretty rosy. Most (but not all) of the stories in the Williston Herald, the Dickinson Press, and the McKenzie County Farmer were positive [note 1]. The boom meant prosperity and hope, a reversal of years of out-migration. In that light, the bust looks light the end of prosperity as jobs – and people – leave.

But if you read the letters to the editor in the same newspapers, the picture was different. Long-time residents felt like they were losing their homes:

The core of our towns is being lost because the locals simply don’t want to live here anymore. They are leaving because the home they knew and loved is no more. They are leaving because they have lost their cherished lifestyle, their peace of mind, their safety – they have lost their western North Dakota. [note 2]

It should come as no surprise that residents framed their fears in terms related to home. The idea of home had undergone a rapid shift, both literally and figuratively. At a literal level, this shift related to the way people valued houses – the structures they called home. Houses are valuable in at least three ways. First, we can buy and sell them: they’re valuable as a commodity. Second, we can live in them: they’re valuable as shelter. Finally, perhaps most importantly, we can make our home in them: they’re valuable for the relationships we form with others – the bonds that link us to our family, friends, and communities.

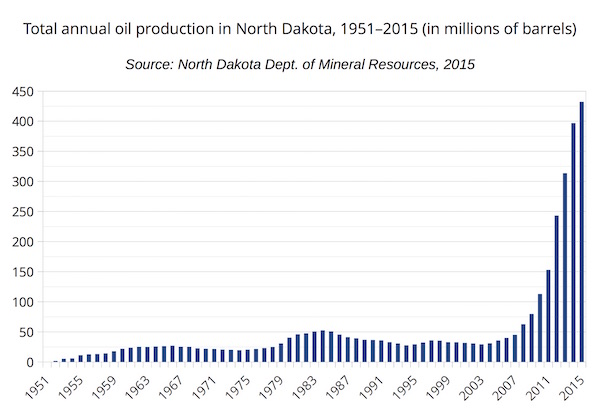

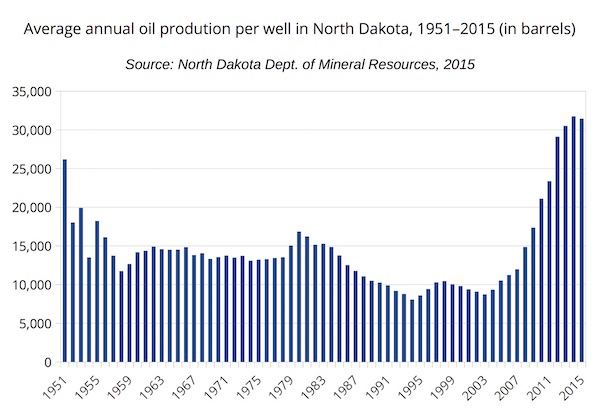

In the Bakken, the relative weight of each of these values shifted between 2008 and 2014, as houses’ commodity value grew. The Bakken boom was typical in that it took place place when natural resources were discovered in a remote area with limited resources. When that area could not provide the necessary workers, employers recruited elsewhere, leading to rapid population growth. When community resources (related to housing, education, law enforcement, medical care, and physical infrastructure) proved inadequate, local governments looked for new sources of revenue. More jobs and higher salaries made for a bigger tax base, but they also led to inflation and increased labor costs. Community members worried about how to adapt their lives to a new social reality. Then, predictably, the bust followed, and many (but not all) newcomers left [note 3].

The increased demand for housing meant people’s houses were worth more as commodities. It also meant landlords could raise rents or sell their properties. When they did, the new owners – frequently the oil companies themselves – could raise rents or evict old tenants to make space for oil workers. Many long-time residents no longer felt a sense of what psychologists call “ontological security,” or the idea that “the stability of the world can be taken for granted” [note 4]. Their anxiety about their literal homes contributed to their anxiety about their figurative home, as the letter to the editor quoted above suggests. “Home” meant not just the structure where they lived, but the community they belonged to, linked as it was to a specific place with specific people. In the most extreme cases, they worried about where to find shelter. In other cases, they worried about the loss of “their cherished lifestyle, their peace of mind, their safety” as so many newcomers descended on the region. Sebastien Braun sums the situation up succinctly: oil turned western North Dakota into a frontier, but “frontiers exist as frontiers for outsiders, on the same land that is home to locals” [note 5].

In fact, the logic of home and housing was rather perverse: people didn’t fall through the cracks in spite of the boom but because of it, and what proved the truth of the boom’s prosperity is precisely the inability to meet residents’ needs [note 6]. A 2014 article from the Williston Herald (versions of which appeared in Time magazine and the New York Daily News) demonstrates this paradox well [note 7]. It described a survey that showed that Williston had the highest rents in the country, beating out perennially expensive places like Manhattan, Boston, and San Francisco by as much as 40 percent. Rents were rising because jobs were plentiful and people wanted to be there. Lack of housing was merely a symptom of Williston’s prosperity: the town was a victim of its own success.

The boom is not over

In my last post, I wrote that the continuity we see in the economics of oil extraction translates into a continuity in the ways people lived (and live) in the Bakken. What I mean is this. Rather than see booms merely as periods of economic expansion, it’s important to see how they are in fact defined by their contradictions. Because production begins to drop off in as little as a month after a well is drilled, contraction was always a factor, even during the height of the boom. It was hidden from view, but it was still a source of anxiety. People wanted to hedge against the eventual downturn, but they faced clear limits in what they could do. Likewise, the paradox I describe in this post has been (and still is) a source of anxiety. Many long-time residents felt dispossessed of their home, in both a literal and a figurative sense.

Thus when I write that the boom is not over, I do not mean that the economy has maintained the same rate of growth as in 2008–2014. What I mean is that the contradictions that shaped those years continue to operate. The main difference between then and now is they have become more visible. The effects of the ever-present contraction became clear when oil companies stopped drilling. The effects of the housing shortage were always clear for people affected by it, but they were made starker when the narrative of prosperity was harder to sustain.

And people continue to feel dispossessed of their home. That feeling certainly influenced the standoff over the Dakota Access Pipeline, at the beginning of which Sioux leaders explained, “This is the third time that the Sioux Nation’s lands and resources have been taken without regard for tribal interests. The Sioux peoples signed treaties in 1851 and 1868. The government broke them before the ink was dry” [note 8]. Of course, this comparison is far more complicated than what I can present in a blog post.

***

This is where I ask what you think. The point of these posts – and this project, really – is to see what emerges from conversation about life in the Bakken. In other words, the point is not to produce a traditional form of scholarship that constantly runs the risk of irrelevance, but to find a way to think together, collectively, to bring conflicting – and complementary – perspectives together. So, what do you think?

Notes

Note 1. Angela Cary, “Covering the Boomtown: How Mediated Communication Has Shaped Life in the Bakken Oil Region,” in The Bakken Goes Boom: Oil and the Changing Geographies of Western North Dakota, edited by William Caraher and Kyle Conway (Grand Forks: Digital Press @ the University of North Dakota, 2016), p. 257–277.

Note 2. Shelly Ventsch, “It’s Not a Matter of If Something Happens, But When,” Williston Herald, December 4, 2012. For a broader examination of this phenomenon, see Joshua E. Young, “Booms and Busts: Haunting Memories in the North Dakota Oil Boom,” in The Bakken Goes Boom, p. 71–90.

Note 3. Charles F. Cortese and Bernie Jones, “The Sociological Analysis of Boom Towns,” Western Sociological Review, vol. 8, 1977, p. 76–90. Later formulations of the boom town model have emphasized the recovery that often takes place after the bust. See Karin L. Becker, “The Paradox of Plenty: Blessings and Curses in the Oil Patch,” in The Bakken Goes Boom, p. 11–29.

Note 4. David Madden and Peter Marcuse, In Defense of Housing: The Politics of Crisis (New York: Verso, 2016), p. 68.

Note 5. Sebastien Braun, “Revisited Frontiers: The Bakken, the Plains, Potential Futures, and Real Pasts,” in The Bakken Goes Boom, p. 95.

Note 6. I’ve adapted this argument from Dominique Perron’s analysis of Alberta in L’Alberta autophage: Identités, mythes et discours du pétrole dans l’Ouest canadien (Calgary: University of Calgary Press, 2013).

Note 7. Jerry Burnes, “Williston Rents Highest in Nation,” Williston Herald, February 15, 2014.

Note 8. David Archambault II, “Taking A Stand at Standing Rock,” New York Times, August 24, 2016.